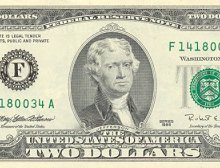

With already lower export and higher import, the Nepalese economy is likely to see further trouble brewing as the Nepalese rupee continues to weaken against the US dollar. This will mean more hardship for the common people -- rising prices and inflation.

After the relentless fall of the Nepalese rupee against the US dollar, which is the currency for Nepal’s trade all over the world and secured loan from bilateral and multilateral agencies, Nepal Oil Corporation has made it clear that the price of current petroleum product will be revised. According to NOC, its monthly loss is now over 1.5 billion rupees monthly. As the prices of petroleum products increase in the international market, further trouble seems to be in store.

Similarly, the government’s foreign debt will increase as it needs to pay more money as interest to multilateral agencies. This will create problems to the national budget which needs to allocate additional money for regular expenditure.

As the festive season is at the doorstep, the weakening Nepalese currency will also affect the import of low price goods from China. According to businessmen, they have not ordered any goods given the uncertain dollar fluctuation.

The Nepali customers from the low-income groups rely heavily on the Chinese goods during the great Hindu festival of Dashain. But, the warehouses in the Tibetan border town of Khasa are empty after the Nepali entrepreneurs chose to cut the order heavily fearing a huge loss in trading in the face of the weakening Nepali currency against dollar.

“We do not feel confident to place orders for the Chinese goods due to the growing value of the dollar. We don´t want to risk our investment,” said Chairman of Sindhupalchowk chapter of the Federation of Nepalese Chambers of Commerce and Industries Rajendra Kumar Shrestha.

With the increasing value of the dollar, the Nepali currency is also losing against the Yuan. The exchange rate of the Yuan against the Nepali rupee now stands at Rs 17, up from Rs 13 some two weeks ago.

According to the report, the Nepali currency has depreciated by more than 17 per cent in the last one year. The Indian rupee slid against a dollar after the US Federal Reserve’s recently released minutes suggested that it will begin tapering its bond buying program as early as next month.

Already wary foreign investors who have been pulling out investments from India rushed further that kept hammering the Indian currency. Despite numerous efforts by the Indian central bank, the Indian currency has become the worst performing Asian currency against the dollar. Analysts are in consensus that recent freefall is triggered by talks regarding US Fed stimulus tapering but the problem is structural in terms of Indian economy. India suffers from huge current account deficit.

As the Nepali rupee has been pegged to the Indian rupee at Nepali Rs 160 to Indian Rs 100 since March 1, 1992, there is no respite for Nepal either. However, Nepalese currency is surviving because of its pegging with the Indian currency.

At a time when the Nepali rupee has been hitting one new low one after another in the recent days, some economists have even questioned the relevance of continuing to peg the Nepali currency to the Indian rupee.

Others see it differently. They argue that the currency peg benefitted Nepal all the time as the southern neighbor has a bigger economy and robust foreign currency reserve.

“The time has come to rethink the peg system. With the Indian currency losing strength sharply against the US dollar, we have to prepare gradually to end the pegging by consolidating our own economy,” said economist Keshav Acharya, economic advisor to CPN-UML led government.

At a time when Nepal´s economy is marred by double digit inflation, slowing growth, a ballooning trade deficit and declining industrial growth, among other woes, Acharya’s extreme views have only a few takers.

“With the country fully embracing an open market economy, it will not be wise to prolong the currency peg indefinitely. The peg meant suffering the adverse impact of a weakening Indian economy,” added Acharya, also a former chief economic advisor at the Ministry of Finance.

Economist Professor Dr. Bishwombher Pyakuryal sees ending the currency peg is an unrealistic argument given Nepal´s weak economic performance. In the face of skyrocketing imports and slowing exports, Nepal has seen its current account surplus drop to around Rs 57 billion from Rs 76 billion last year. Similarly, the balance of payments tumbled to Rs 69 billion from around Rs 132 billion over the year.

“It is not easy to end the peg as floating the exchange rate of the Nepali rupees in the open market will destabilize the Nepali economy which is already in various difficulties,” he said.

Meanwhile, the Nepali rupee weakening against the dollar means more reasons to be upset than to be upbeat.

The government can mobilize more customs duty, VAT and excise duty with the rise of the import bill jacked up by the rising value of the dollar. But the stronger dollar has driven up the import price of raw materials for manufacture, spawned double digit inflation, and worsened the trade deficit. With the whopping rise in civil servant salaries and industrial worker wages as well as hike in petroleum prices pushing up inflation, a rising import bill will further worsen the situation.

Being an import-based economy, the rupee depreciation makes a huge impact on the economy. As more money should be spent for purchasing the dollar, goods imported from countries other than India have become expensive. Economists say a weak rupee will push up inflation that is already threatening to touch double digits. .

Rajesh Kaji Shrestha, president of Nepal-China Chambers of Commerce and Industry, said there would be a significant price rise if the rupee freefall continued. He said the prices have already risen by 25-30 percent.

Pain ahead

The rupee has had a sharp fall since May and is menacingly threatening to canter past Rs. 110 to a dollar. If the country's top economy managers have gone into a huddle after the currency's recent slide, it is only symptomatic of the anxiety inflicting India's broader economy. Analysts warned of more pain ahead as the world settles down to a new normal state of economy.

Debesh Adhikari

Adhikari is a computer science student and writes on various contemporary issues.

- The UK Expressed Deep Concerned About Tensions in Nepal

- Mar 09, 2017

- Development Partners and Ministry of Education Agree to drive quality education

- Sep 28, 2016

- END HUNGERNepal plans to end hunger by 2025

- Mar 14, 2016

- UK Hopes For Inclusive Resolution For Nepal

- Sep 17, 2015

- Micromax Launches Bolt D320 For Nepali Market

- Aug 07, 2015