Nepal Rastra Bank (NRB) has brought in monetary policy for the upcoming fiscal year 2018/19 with a number of measures aimed at addressing the skyrocketing lending rates in recent months.

Among other things, the monetary policy statement unveiled by NRB Governor Chiranjibi Nepal on Wednesday has reduced the average difference between the deposit rate and lending rate to 4.5 percent from 5 percent.

This measure implies that a bank would not be allowed to charge higher than 4.5 percent of their average deposit rate. As the central bank is requiring commercial banks to bring the interest spread to 4.5 percent by the end of upcoming fiscal year, the reduction in the spread will put downward pressure on runaway bank interest rates.

“The decision to reduce the spread is positive as we can now expect that it will help reduce the interest rates which have become so high that business firms were unable to afford them,” Shekhar Golchha, senior vice president of Federation of Nepalese Chambers of Commerce and Industry (FNCCI), told Republica. “We are hopeful that this monetary policy will address the ultra-high and unpredictable interest rates regime in the country,” he added.

Not only has the central bank reduced the interest spread, NRB Governor Nepal also announced that the difference between what a bank pays and charges in interest will be further cut gradually.

Another way the central bank has tried to put a lid on rising lending rate is by providing banks and financial institutions (BFIs) sources of funds.

The central bank has nearly doubled the size of the refinance fund to Rs 35 billion. The increased size of the fund which was inadequate during the liquidity crunch will ensure that business firms will have financing at a concessional rate of 9 percent.

“The increase of the fund size will provide relief to business firms and industries in priority sectors,” said Golchha, urging the central bank to also increase the maturity period of such concessional loans.

The lowering of the cash reserve ratio (CRR) and statutory liquidity ratio (SLR) for banks and financial institutions is another way that the central bank has found for putting downward pressure on the base rate of banks, which is tied to the lending rate. After five years, the central bank has lowered the CRR and SLR. CRR—the portion of the cash deposits that banks are required to park in the central bank vault—has been brought down to a flat 4 percent from 6 percent of CRR for commercial banks, 5 percent for development banks and 4 percent for finance companies.

Similarly, the SLR, the reserve requirement including both in cash and government securities, has also been lowered to 10 percent from 12 percent for commercial banks, 8 percent from 9 percent for development banks and 7 percent from 8 percent for finance companies.

“The reduction in reserve requirements for BFIs will help to free up additional cash in the banking system and ease liquidity,” said Chintamani Shiwakoti, a deputy governor of NRB. “This measure combined with other provisions like reduction in bank rate in the monetary policy will gradually correct the rising interest rates,” he added. The central bank has reduced the bank rate to 6.5 percent from 7 percent.

Bankers agree

“This monetary policy is aimed toward reducing the interest rates that we have been seeing rising rapidly in recent months,” said Bhuvan Kumar Dahal, CEO of Sanima Bank Ltd. “The base rate will decrease by some percentage points due to reduction of CRR in the monetary policy which means borrowers will benefit,” said Dahal.

The central bank has also announced to provide hedging facility for the foreign currency loans that banks bring to the country to expand into productive sectors.

"Such facility will reduce the high hedging cost for banks in the international market which means that the cost for borrowers who benefit from such funds will also go down", reports My Republica.

According to The Himalayan Times, the Highlights of Monetary Policy For 2018/19 includes:

– Weighted interest rate spread- 4.5 per cent

– Broad money supply – 18 per cent

– Private sector credit growth 20 per cent, total credit growth 22.5 per cent

– Expansion of refinancing window from Rs 25 bn to 35 bn

– Forward contract facility on exchange rate risk to foreign borrowing of the commercial banks up to 25pc of their core capital

– Commercial banks can also borrow in Indian currency from foreign banks under the foreign borrowing facility

– Cash Reserve Ratio (CRR) to four per cent for commercial and development banks from six and five per cent

– Statuary liquidity ratio 10 per cent, 8 per cent and seven per cent to commercial banks, development banks and finance companies, respectively from 12, 9 and 8 per cent respectively

– Commercial banks must float 15 per cent of the total loan portfolio to the energy and tourism sector

– Full audit of the big branches of the commercial banks mandatory

– Credit rating of borrower that utilise credit of Rs 500 million and above is mandatory

– Margin call only if the stock prices plunge over 20 per cent of the collateral value

– Margin lending only 25 per cent of the stock value taken as collateral

– Ceiling in over draft loan at Rs five million from Rs 7.5 million

– Upper floor of the interest rate corridor minimised at 6.5 per cent and lower floor expanded to 3.5 per cent

– Deprived sector lending 5 per cent of the total loan portfolio for class ‘A’ , class ‘B’ and class ‘C’ financial institutions from earlier 5 per cent for class ‘A’ , 4.5 per cent class ‘B’ and 4 per cent for class ‘C’ financial institutions

– Provision to calculate up to Rs 1.5 million loan in group guarantee for women can be calculated under deprived sector loan and loan to dalit, marginalised community, educational loan, loan against collateral of academic certificates also can be calculated under deprived sector loan

– Only one percentage point can be added in published fixed deposit rate to the interest on institutional deposits

– Cap on institutional deposit for class ‘A’ , class ‘B’ and class ‘C’ financial institutions. Institutional deposit must be narrowed down to 45 per cent and single institutional depositor limit 15 per cent

– Funds collected by the financial institutions through issuance of bond/debenture can be calculated in credit to core capital plus deposit (CCD) ratio

– Presence of commercial banks must in every local unit and the deposit collected in the remaining 116 local units provided relaxation from CRR and SLR calculation for next three years from 2018-19

– Ban on stitching Nepali bank notes

– Deposit up to Rs 3 lakh will be insured from existing Rs 2 lakh

– Issue collateral valuation guidance to keep uniformity in collateral valuation

– Cap on interest of micro finance institutions (MFIs). MFIs can add only 6 percentage point on their cost of fund while fixing lending rates

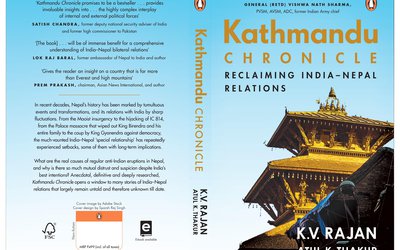

- Kathmandu Chronicle: Reclaiming India-Nepal Relations

- Apr 20, 2024

- India Provided Financial Support To Build Schools In Darchula

- Apr 20, 2024

- Iranians Protest After Attack

- Apr 20, 2024

- Weather Forecast: Light Rain Is Likely To Occur At Few Places In Koshi, Bagmati, Gandaki And Karnali Provinces

- Apr 20, 2024

- Japanese Ambassador Kikuta And DPM Shrestha Shared The Views to Deepen Nepal-Japan Bilateral Relations

- Apr 19, 2024