Resilience of the economy to natural hazards is determined by a complex, dynamic set of influences that include country’s government and financial market, fiscal policy and monetary objectives, among others. In the case studies of recovery from disaster, Nepal stands as a text book example of how a country struggles to reconstruct from lingering impact of the calamity because of the poor fiscal and monetary management, and the lone parochial financial systems that do not help mollify the aftermath.

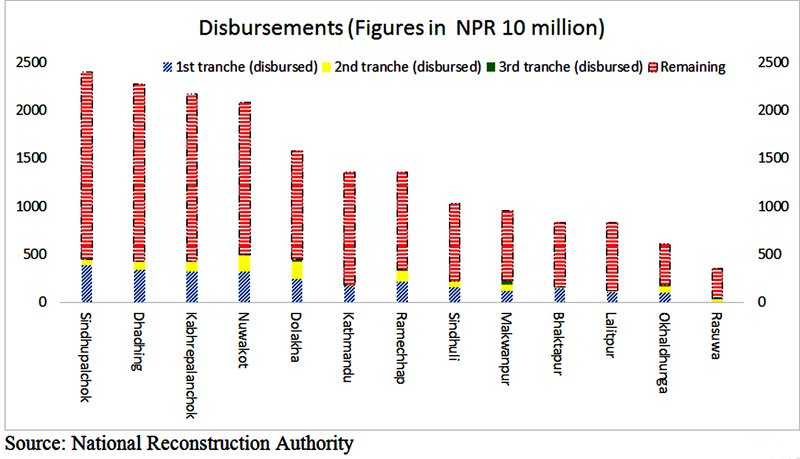

Nepal has made derisory progress towards rebuilding damaged properties, and disbursal of housing grants after 2015 earthquake. In two years’ time, total amount disbursed grants for the private housing reconstruction is meagre NPR 40 billion, whereas two of the top four grants receiving districts Dhading, Sindhupalchok, Kavrepalanchok, including capital city, Kathmandu, have not received third tranche till October 2017. The government has disbursed less than 140 billion, out of which NPR 40 billion is for private housing reconstruction which boils down to less than NPR 250,000 per beneficiary. Fortunately, the speed of grant distribution has accelerated in the last few months as the National Reconstruction Authority (NRA) —government body that oversees reconstruction activities — set up a deadline for finishing the rebuilding.

Even at the monetary front the uptake of concessional loan is not in an optimal volume, which is evident from the fact that by the end of fiscal year 2016-17, the financial institutions have disbursed merely NPR 816 million to 382 survivors, while over 505,000 private houses were completely battered, and around 279,000 houses were partially damaged due to earthquake. While for credible explanations, greater analysis is required, it appears that the banks are lending to applicants with comfortable collateral margin. The loans are being exclusively directed towards the individuals with decent income, adequate collateral, and those who can present evidence from the respective local bodies that they do not own any other habitable house. Not many survivors could fulfil all the criteria. Also, financial institutions are delimited from charging the borrowers of the subsidized loan any amount except the interest and third-party payments like insurance, collateral, loan notice, and loan security which has not motivated the financial institutions to further push the lending.

Moreover, even the disbursement of the housing grant from the banking system has been a late starter for the reason that the government was unwilling to pay for the banking service charge. To make matters worse bank financing at two per cent and central bank refinancing at zero percent interest rate was not pragmatic for the reason that banks were uncomfortable with such a low rate, to cover credit administrative and monitoring costs. Admittedly, coupled with these issues there are apprehensions amid banking industries concerning the default of assets.

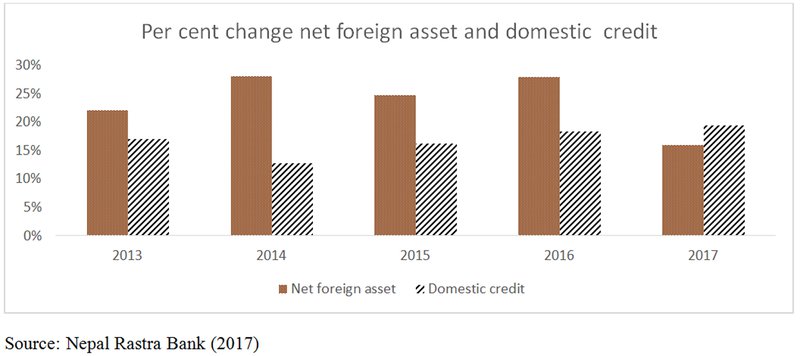

Net foreign assets and domestic credit have also

not shown any significant change, which signals that there was no substantial

spill over to the money system through bank financing and the committed foreign

aid for reconstruction as disbursement in both the cases were dismal.

Although, for Nepal, there exists an ample fiscal latitude to go for deficit financing, relatively poor-quality public spending has made fiscal policy less successful. The country must leverage on deficit financing simply for the reason that the capital constraints would otherwise hinder the economic growth process and aggravate low-investment-low growth-low saving-low investment cycle. The continuing fiscal laxity owing to inability of prudently spending the budget is not ideal for low-income country with huge investment needs for reconstruction and infrastructure development.

Also, as a way forward in the monetary front, the conditions set for borrowings and reluctance of the banks to lend credit to the affected households should not remain unresolved issue. In doing so the government and the central bank should remove the grey areas of the policies, and ease terms and conditions for housing grant.

Mere concessions in policy do not suffice the evidence suggests and required will be credible incentives and monitoring and implementation capabilities among others. Admittedly, a myriad of other factors such as prompt and practical decision of the NRA in releasing funds, availability of technical and manual workers, and willingness of the household and public sector entities to expedite construction has also acted to amplify or dampen the economic reinvigoration. However, for the government, especially the upcoming government to start with, architecting complementary fiscal and monetary moves that dovetails the financial system will help reflect some positive message to the destitute Nepalese marred by the sorry state of affairs.

This is an excerpt of part of a study made for ‘Initiating Dialogue on Post-Disaster Reconstruction. The discussion program was organized by SAWTEE With support from The Asia Foundation.