Small Farmers Development Program (SFDP) was initiated in 2032 (1975 AD) to address acute and widespread poverty in the country. The SFDB adopted holistic approach to alleviate poverty. The program was piloted in Mahendranagar of Dhanusha and Tupche of Nuwakot, covering both Plain and Hill of the country.

SFDP was the first group-based and credit plus development initiative dedicated to work for the transformation of poor and under privileged people who are left behind from the mainstream of development. The program offered micro credit for income-generating activities along with a saving program. The program also provided non-financial services such as skill development trainings, health, awareness, and small infrastructure improvement activities to help promote wellbeing of small farmers.

The program was initially implemented by Agriculture Development Bank Ltd (ADBL). SFDP service has reached to 2 lakhs 10 thousand farmer families of 652 then village panchayat (Local Municipalities) of 75 districts Until by the fiscal year 2048/049 (1991/1992 AD). The quality of loan provided under SFDP started deteriorating, due to rapid expansion and lack of supervision of the program. Responding to this challenge, ADBL introduced Institutional Development Program (IDP) in 1987 to transfer SFDP into member owned and managed Small Farmer Agriculture Cooperative Ltd (SFACLs) with the financial and technical support from GTZ. Two hundred twenty-eight SFACLs were formed by under IDP. The transformation of program into autonomous and member-owned financial institutions has helped to improve the loan quality, reduce the cost and thereby enhancing the sustainability of the program.

Need of a dedicated institution was felt to provide continuous financial and non-financial services to SFACLs together with supervising and building their institutional capacities. Therefore, Sana Kisan Bikas Laghubitta Bittiyasanstha Ltd (SKBBL)-in English Small Farmer Development Microfinance Financial Institution was established in 2001 to provide continuous services to SFACLs.

In order to provide accessible services to un-served and under-served communities, SKBBL has adopted Farmers to Farmer replication approach wherein sustainable and well managed SFACLs are given opportunity to replicate new SFACLs in neighboring villages. As of now total one thousand three hundred and nine partner cooperatives haven been formed through this process and additional 155 cooperatives are in the process of replication.

The loan portfolio of SFACLs has grown from 2 billion to 85 billion from 2001 to 2022. Out of the total loan mobilized by partner cooperatives, only 35 percent i.e., NPR 30 billion has been provided by SKBBL and the rest 65 percent has been mobilized by the partner cooperatives locally as a members’ share and savings.

Of total Share capital of SKBBL, 44% is owned by 231 Small farmers cooperative, 22 % by Agricultural Development Bank Limited (ADBL), 1% by Nepal bank Limited, 3% by Nabil Bank Limited and 30% by the Public.

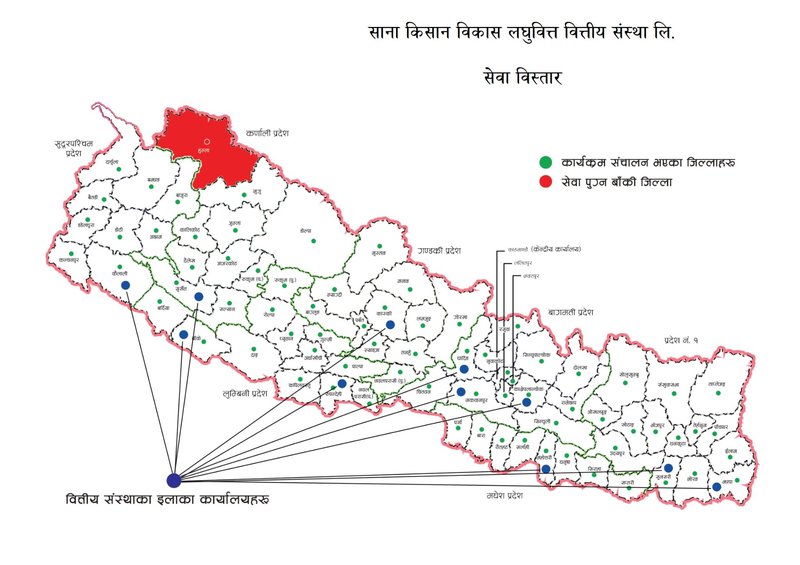

SKBBL provides wholesale credit to its partner cooperatives and the cooperatives in turn provide retail credit to its member farmers. SKBBL is providing its services through its 11 area offices covering 542 Municipalities and 77 districts (except Humla), out of total 753 Municipalities and 77 districts of the country.

As of July 2022, SKBBL is providing its services to one million households through its network of one thousand three hundred and nine small farmer cooperatives. The beneficiaries of SKBBL include 79 % women, 11% Dalit, and 38 % indigenous and ethnic minorities.

With the support and collaboration of Nepal Government and different donor agencies, SKBBL has been operating projects related to agriculture and livestock enterprises, skill, and enterprise development,

Supports and Collaborations

Ø Ministry of Finance, Government of Nepal

Ø Asian Development Bank

Ø International Fund for Agricultural Development (IFAD)

Ø Department for international Development (DFID), UK-AID

Ø United Nations Capital Development Fund (UNCDF)

Ø German Technical Cooperation (GIZ)

SKBBL is implementing the “Learn and Earn Program” in collaboration with the Embassy of Israel and the government of Nepal. Three thousand one hundred and sixty-two youth from small farmers family are directly benefited from it. They have returned Nepal after the completion of 11 months training program on Modern agriculture and Animal husbandry practices.

The returnee trainees are now engaged in commercial farming and livestock rearing in different municipalities. It is showcasing how the adaptation of knowledge and technology in farming help enhance agriculture production and productivity.

Currently the youth involvement in Agriculture and Animal husbandry has significantly increased through demo effect.

As per the study of an independent agency conducted in the year 2020, the livestock credit provided through SKBBL has helped increase the meat and milk production by 5 times and the annual income of livestock rearing farmers by 11 times.

At present the cooperatives, with the support of SKBBL, are working in various areas including cooperative farming, Forest and environment protection, infrastructure development, milk collection center, cold storage operations, food processing, agriculture and livestock promotion activities, skills and capacity development, technical support, and supplies of agriculture inputs such as fertilizer, seeds, equipment's, and pesticides.

SFACL is a unique three-tiered organizational structure, which ensures the involvement of women and disadvantaged members in decision making process. The SFACL forms the groups comprising 5-12 members of small farmers, poor, and people from deprived communities at the neighborhood. This has been one of the exemplary and successful models for poverty reduction and empowerment of rural communities in Nepal.

Recognizing the positive impact of this model, The Consultative Group to Assist the poor (CGAP)/World Bank has awarded SKBBL with Pro-Poor innovation Challenge (PPIC) award of USD 50,000 in 2003.

Likewise, it was honored with the “Best Managed Microfinance Development Bank” Award.In 2014.

In addition, Rural Enterprise Financing Project implemented by SKBBL has been awarded by Ministry of Finance and Asian Development Bank for exemplary work in 2020 during COVID Pandemic.

SKBBL has been implementing various activities related to agro enterprise development as well as strengthening different agriculture value chain activities including production, processing, storage and marketing. It aims to expand its services to all the 77 districts of Nepal within 5 years, increase the loan portfolio from 30 billion to 60 billion, transform the traditional farming system to modern and technology-based farming. Additionally, it has also focused to carryout various activities for the involvement of women, youth, and deprived communities in different development endeavor.

SKBBL has envisioned to be established as a national level specialized bank dedicated to rural and agriculture transformation.

Dr. Shivram Prasad Koirala Chief Executive Officer,Dr. Nav Raj Simkhada,Deputy Chief Executive Officer Sana Kisan Bikas Laghubitta Bittiyasanstha Ltd (SKBBL)