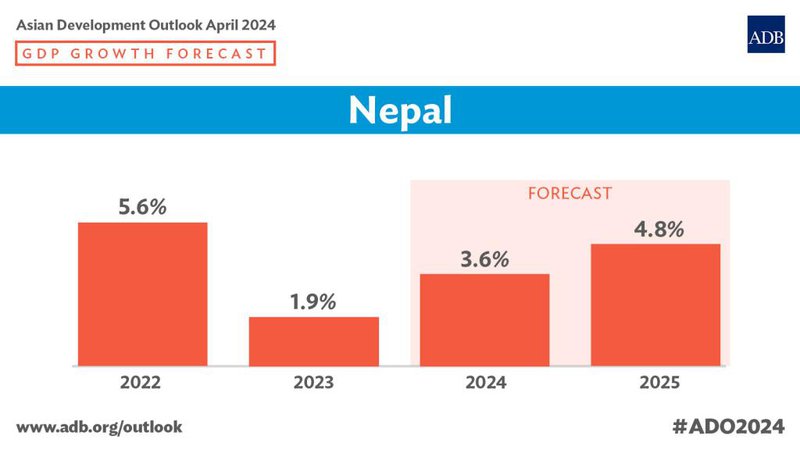

Nepal is expected to experience an upturn in its economic growth this year and in fiscal year 2025. This positive trend can be attributed to the increase in hydropower production, the recovery of the tourism sector, and the gradual improvement in domestic demand.

However, the Asian Development Bank predicts a decline in growth for fiscal year 2023 due to the tightening of financial conditions following the pandemic situation. Additionally, inflation is expected to rebound as oil and other commodity prices soar.

Nepal’s economy is anticipated to grow by 3.6% (at market prices) in fiscal year (FY) 2024, up from an estimated growth of 1.9% in FY2023, says the latest Asian Development Outlook (ADO) April 2024, a flagship publication of the Asian Development Bank (ADB).

"A gradual relaxation of monetary policy coupled with improved consumer and investor confidence is expected to stimulate economic activity in FY2024. Moreover, industry is projected to grow more rapidly than in FY2023 as capital spending by the government ramps up in the second half of the fiscal year, and as additional hydroelectricity power comes online by the end of FY2024,” said ADB Country Director for Nepal Arnaud Cauchois.

Service sector growth will also likely accelerate as credit controls ease, interest rates further decrease, and tourism revenues expand. Agriculture growth may increase marginally from 2.7% in FY2023 to 2.8% as a record rice harvest is tempered by a shortfall in winter crops and other agricultural production, given the deficient rainfall this winter season.

The report projects annual average inflation to fall to 6.5% in FY2024 from 7.7% in FY2023 on subdued oil prices and a decline in inflation in India, Nepal’s main import source.

External risks remain relatively well contained. The current account deficit may fall again into deficit after registering a surplus in the first half of FY2024. As the trade deficit contracted by 4.7% year-on-year in the first 6 months of FY2024, and as workers’ remittances expanded by 22.6% year-on-year, the current account recorded a surplus of $1.2 billion. However, amid higher imports and stable remittance inflows in the remainder of the fiscal year, the FY2024 current account deficit is forecast at 0.7% of gross domestic product.

“Downside risks to the economic outlook in FY2024 may arise from a downturn in the global economy affecting Nepal’s tourism and remittance receipts,” said ADB Principal Economist for Nepal Jan Hansen.

Hansen has provided an explanation regarding the threat to Nepal's economic growth caused by extreme weather patterns. He mentioned that the Asian Development Bank will assist in making Nepal's infrastructure resilient to the impact of climate change.

Discussing Nepal's perspective, Manbar S. Khadka, a Senior Economics Officer at Asian Development Bank Kathmandu, stated that Nepal's economy is gradually recovering.

Khadka also emphasized the economic indicators of Nepal, illustrating its growth as well as identifying certain weaknesses and risks in the Nepalese economy for the future. He recommended increasing investment to enhance the infrastructure.

During the press conference, Sameer Khatiwada, an Economist at Asian Development Bank, addressed the need for Nepal to establish a sustainable foundation for achieving higher economic growth.

Any intensified geopolitical turmoil could disrupt supply chains, pushing up global inflation and tightening global financial conditions. This may lead to a tightening of domestic monetary policy, undermining investment and consumption, and dragging down growth.

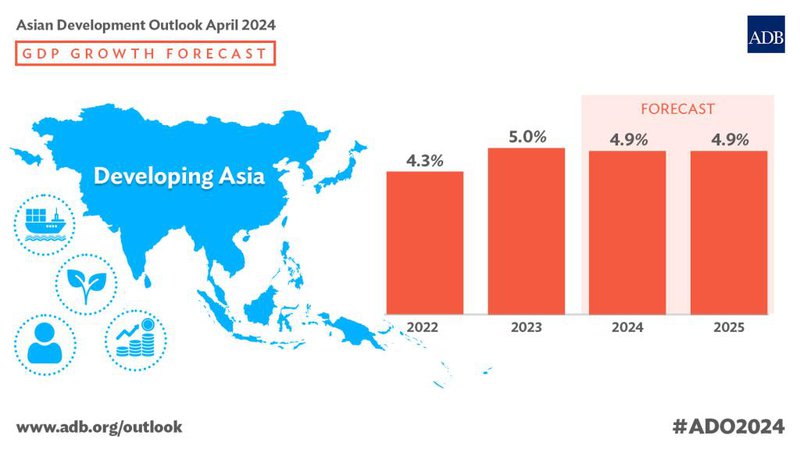

Developing Economies In Asia to Grow By 4.9 Percent

Developing economies in Asia and the Pacific are forecast to expand by 4.9% on average this year as the region continues its resilient growth amid robust domestic demand, improving semiconductor exports, and recovering tourism.

Growth will continue at the same rate next year, according to the Asian Development Outlook (ADO) April 2024, released today by the Asian Development Bank (ADB). Inflation is expected to moderate in 2024 and 2025, after being pushed up by higher food prices in many economies over the past 2 years.

Stronger growth in South and Southeast Asia—fueled by both domestic demand and exports—is offsetting a slowdown in the People’s Republic of China (PRC) caused by weakness in the property market and subdued consumption. India is expected to remain a major growth engine in Asia and the Pacific, with a 7.0% expansion this year and 7.2% next year. The PRC’s growth is forecast to slow to 4.8% this year and 4.5% next year, from 5.2% last year.

“We see strong, stable growth for the majority of economies in developing Asia this year and next,” said ADB Chief Economist Albert Park. "Consumer confidence is improving, and investment is resilient overall. External demand also appears to be turning a corner, particularly with regard to semiconductors.”

Policy makers should remain vigilant, however, as there are a number of risks. These include supply chain disruptions, uncertainty about US monetary policy, the effects of extreme weather, and further property market weakness in the PRC.

Inflation in developing Asia and the Pacific is expected to decline to 3.2% this year and 3.0% next year, as global price pressures ease and as monetary policy remains tight in many economies. However, for the region excluding the PRC, inflation is still higher than before the COVID-19 pandemic.

Rice prices have contributed to higher food inflation, especially for import-reliant economies. Prices for rice are likely to stay elevated this year, according to ADO April 2024. Reasons include crop losses due to adverse weather and India’s restrictions on rice exports. Increased global shipping costs, due to attacks against ships in the Red Sea and drought in the Panama Canal, may also add to inflation in Asia, according to the report.

To tackle surging rice prices and protect food security, governments can give targeted subsidies to vulnerable populations and enhance market transparency and monitoring to prevent price manipulation and hoarding. In the medium to longer term, policy should focus on establishing strategic rice reserves to stabilize prices, promoting sustainable farming and crop diversification, and investing in agricultural technology and infrastructure to raise productivity. Regional cooperation can also help manage rice prices and their impact, the report says.

ADB is committed to achieving a prosperous, inclusive, resilient, and sustainable Asia and the Pacific, while sustaining its efforts to eradicate extreme poverty. Established in 1966, it is owned by 68 members—49 from the region.

- Nepal Is Expected To See 60,000 People Infected with Dengue This Year

- Jul 04, 2025

- Journalist Pathak ordered to be released on bail of Rs 25,000

- Jul 04, 2025

- IPPAN To Hold Ninth Power Summit in September: IPPAN President Karki

- Jul 04, 2025

- Weather Forecast: Generally Cloudy Across The Country With Heavy Rain At One Or Two Places In Koshi, Bagmati And Lumbini Provinces

- Jul 04, 2025

- Global IME Capital’s “Samunnat Yojana 2” Mutual Fund Opens for Public Offering from July 6

- Jul 03, 2025