Dr. Paudel's presentation of promises, populist rhetoric, and commitments to boost growth left many disappointed. In a move that seemed to favor a select few powerful real estate and share brokers, Dr. Paudel compromised the interests of millions of depositors by lowering interest rates below the inflation level.

In contrast to his predecessor Maha Prasad Adhikary, who stood firm on interest rate limits, Dr. Paudel chose to reduce interest rates to appease a small group of brokers.

"I am extremely disappointed with the new Monetary Policy unveiled by Dr. Paudel, a UC Berkeley graduate. I am puzzled by the approach he has taken," remarked a senior economist speaking on the condition of anonymity.

Controversial Provision

The Nepal Rastra Bank (NRB) has made provisions in the upcoming monetary policy for the next fiscal year to allow banks and financial institutions (BFIs) to invest the regulatory reserve allocated for non-banking assets acquired in the past two years.

Governor Dr. Biswo Nath Paudel stated in clause number 93 of the newly released monetary policy that the regulatory reserve created from non-banking assets taken over in the last two years can now be considered as supplementary capital. This means that BFIs can now invest the losses incurred from non-banking assets they have acquired, as these losses can be included in the capital structure.

Currently, BFIs hold non-banking assets totaling NPR 45.11 billion, with commercial banks holding NPR 28.79 billion, development banks holding NPR 4.16 billion, and finance companies holding NPR 2.74 billion.

The more non-banking assets a bank or financial institution holds, the larger the amount they must set aside as a regulatory reserve. With limited recovery, most BFIs currently allocate significant amounts for this purpose. However, under the new monetary policy, BFIs will now be allowed to invest the reserve earmarked for the NRB. This provision is expected to alleviate capital pressure and encourage investment among stressed banks and financial institutions.

Despite the immediate relief this provision offers to capital-stressed institutions, bankers caution that allowing the investment of funds set aside for risk management could pose long-term risks.

The Rastra Bank has announced that the regulatory reserve, which has been built up from non-banking assets acquired in the past two years, can now be considered as supplementary capital," the banker explained. "This decision provides some immediate relief to struggling banks and financial institutions. However, given the increasing amount of bad loans, utilizing these risk-provisioned reserves for lending could pose long-term risks."

Most of the institutions facing challenges are development banks and finance companies, with some even having negative capital. Additionally, two commercial banks are operating below the minimum capital requirement. Another banker shared similar concerns, noting that while clause 93 of the monetary policy offers some relief, it could also heighten systemic risk:

"At present, certain banks and financial institutions are unable to make investments due to capital shortages, despite having liquidity. They are facing difficulties in loan recovery. Allowing the regulatory reserve to be used for investments in such circumstances could potentially increase risks," the banker cautioned. "The implementation of this provision in the monetary policy may lead to further financial strain for development banks and finance companies."

When loans secured by collateral remain unpaid, the collateral must be auctioned off. If the collateral cannot be sold, the institution must take possession of the asset and set aside provisions for the loss, with 100% of the loss being provisioned in such cases.

The upcoming Monetary Policy for the Fiscal Year 2025/26 aims to enhance private sector credit, address non-performing loans (NPLs) and non-banking assets, and boost the share market.

In the midst of increased liquidity in Banks and Financial Institutions (BFIs), the NRB has announced a reduction in the bank rate from 6.5 percent to 6 percent and the deposit collection rate from 3 percent to 2.75 percent. Additionally, the policy rate has been lowered to 4.5 percent from the current 5 percent, as stated by Dr. Poudel during the unveiling of the Monetary Policy.

The decreased bank rate makes borrowing from banks more accessible, while the lower policy rate decreases the overall cost of credit in the economy. The adjustment in the deposit rate reduces the incentive to save and encourages more investment or spending. These measures combined could lead to increased liquidity in the market, higher demand, and potential inflation.

The central bank is optimistic that these actions will encourage increased lending by banks to businesses and individuals, resulting in lower lending rates for home, business, and personal loans without a significant risk of high inflation. NRB Spokesperson Kiran Pandit noted that the inflation rate was at a comfortable 2.72 percent in mid-May to mid-June, compared to 4.17 percent during the same period last year. With some room for inflation, the moderation in interest rates is not expected to disrupt this balance or significantly drive prices up.

He mentioned that the interest rate corridor has been slightly lowered to stimulate economic activities and enhance market dynamism. Additionally, the Nepal Rastra Bank (NRB) has implemented a flexible approach in real estate lending, increasing the maximum limit for residential home loans for individuals purchasing a house to Rs. 30 million from the previous Rs. 20 million. Furthermore, first-time homebuyers can now avail residential loans of up to 80 percent of the property's assessed value, up from the previous limit of 70 percent. Similarly, the loan-to-value ratio for land and property purchases has been raised to enable financial institutions to finance up to 70 percent of the assessed value, compared to the previous allowance of 50 percent.

Margin lending limit raised

Governor Dr. Poudel has raised the limit on margin lending from Rs. 150 million to Rs. 250 million for personal share-backed loans. This change allows individuals to borrow up to Rs. 250 million by pledging shares as collateral across various banks and financial institutions, potentially boosting share market growth due to lower interest rates. Finance companies can now mobilize deposits without a cap, exceeding the previous limit of 15 times their core capital, which may attract more deposits and positively impact share prices.

Microfinance companies can now distribute dividends above the 15% limit from their profits, potentially increasing share prices for class 'D' microfinance institutions. Commercial banks can increase their capital with central bank approval and count regulatory reserves from non-banking assets towards supplementary capital for up to two years. T

The new monetary policy aims to strengthen banks' capital base, requiring central bank approval for capital increment plans. The government will facilitate the implementation of concessional loans mentioned in the fiscal year 2025/26 budget statement. Laws and regulations will be drafted to allow BFIs to establish asset management companies for managing non-performing assets and initiate the establishment of a Neo Bank to enhance financial inclusion as outlined in the government's budget.

Loan to migrant workers to be 'deprived sector'

A new provision has been announced to classify loans (with or without collateral) up to Rs. 300,000 obtained by youth seeking foreign employment as 'deprived sector lending'. For women seeking jobs abroad, this amount could go up to Rs. 500,000. Additionally, there will be a review of the criteria for target groups, loan recipients, and lenders' qualifications for microfinance institutions. The limit on the amount of foreign currency Nepali citizens can carry while traveling abroad has been raised to USD 3,000.

The central bank will introduce a new program called 'Nepal Rastra Bank with Borrowers' to address borrower complaints, especially in rural areas.

Governor Dr. Poudel stated that the NRB will collaborate with relevant government agencies to mitigate risks associated with problematic activities during loan recovery or loan regularization by banks and financial institutions following legal procedures.

Concession to mid-hill businesses

The central bank has introduced a new initiative by offering concessional loans to businesses located along the Mid-Hill Highway and Postal Highway at an interest rate of the base rate plus 2 per cent. To be eligible for this benefit, businesses must be registered with the government and meet all specified quality standards.

Furthermore, financial institutions will now have the authority to provide agriculture or business loans up to Rs. 1 million by independently evaluating factors such as agriculture yield, land, and business structure.

Governor Dr. Poudel, while unveiling the monetary policy, emphasized the adoption of a cautious and flexible approach. The policy includes the approval and implementation of the second financial sector strategy. The bank rate, which acts as the upper limit of the interest rate corridor, has been set at six per cent, with the policy rate at four and a half per cent, down from the previous rates of 6.5 per cent and 5 per cent, respectively.

Additionally, the monetary policy has raised the limit for loans for private residential house construction and purchase from Rs 20 million to Rs 30 million. For the first house, a loan-to-value ratio of up to 80 per cent is allowed, while for subsequent houses, a maximum of 70 per cent can be availed.

The maximum limit for personal share collateral loans has been increased from Rs 150 million to Rs 250 million. Moreover, the amount of foreign currency Nepalese travelers can carry has been raised from two thousand five hundred US dollars to three thousand US dollars.

The monetary policy aims to achieve a 12 per cent increase in private sector loan disbursement in the upcoming fiscal year, although the strategy to achieve this target remains to be seen.

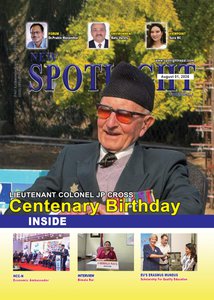

- EU’S ERASMUS MUNDUS: Scholarship For Quality Education

- Aug 05, 2025

- ADB: Partnership For Growth

- Aug 04, 2025

- HCC-N: Economic Ambassador

- Aug 03, 2025

- MELAMCHI WATER SUPPLY: No Interruption During Monsoon

- Jun 25, 2025

- KOREAN RETURNEES: Successful Integration

- Jun 25, 2025