For the third consecutive quarterly financial disclosure, Upper Tamakoshi Hydropower Limited (UTKHPL) has generated income. According to the unaudited 3rd quarter Statement of Financial Position, the company has submitted Rs. 5,163,334,201.35 bill to NEA up to the month of 2078, Chaitra 30. However, the company has received 2,76,04,70,418 with some provisional deductions. UTKHPL officials clarified that such deducted majority of amounts has been recovered so far.

Started full commercial production from Bhadra 25, 2078, UTKHPL has been generating the electricity in full capacity. However, compared to first and second quarterly, the income in the third 3rd quarter has reduced due to the low flow of water in the river and the reduction of Rs. 83,79,94,492 by NEA. Similarly, payment for increased interest rates and depreciation costs increased the loss amount of the company said unaudited 3rd quarter Statement of Financial Position released on Baisakh 2079.

“As NEA has already refunded Rs. 2,76,04,70,418 and NEA are in the process to refund the remaining amount, the company’s loss will reduce and improve the cash flow.” As per the current selling rate, there is no possibility to drastically increase the income and cash flow as expected by the company,” states the statement.

To turn the company into a profit, the company is taking several initiatives including negotiations with financial institutions the revise the interest rates and reforms in other financial management, and equity adjustments in assets. The company is also working to capitalize on various structures of its asset.

To expand income, UTKHPL is considering a second expansion stage, the 20-MW Rolwaling Khola Hydroelectric Project (RKHEP), which would contribute another 105 GWh of energy and enhance 210 GWh dry season energy from UTKHEP. After the completion of the process, the financial position will change in better way.

Share Structure

The majority share (51%) of the Company is held by four public entities, namely, Nepal Electricity Authority (NEA), Nepal Telecom (NTC), Citizen Investment Trust (CIT) and RashtriyaBeemaSansthan (RBS). NEA has a 41% stake, NTC has a 6% and CIT & RBS each have a 2% stake in the company.

Distribution of certificates for Recognition to those who worked on the project by PM Sher Bahadur Deuba

Similarly, the general public and residents of Dolakha district are holding 15% and 10% share respectively. The remaining 24% share has been held by contributors to the Employees Provident Fund (EPF), NEA & Company’s staff and staff of Institutional organizations providing loans to the company.

This indicates that the general public has also made a big investment through the company’s initial public offering (IPO).

Share Of Company

Although the project is one of the best projects so far in terms of energy generation, the share prices of the company are yet to reflect it. In the one-year period, the price of the share has fluctuated from Rs.781 to Rs. 535 now.

The 456 MW Upper Tamakosi, Nepal's largest so far, reached a milestone on July 6 with one of its six 76-megawatt units starting power generation

Inaugurated in July, UTKHPL started the commercial operation date (COD) on 20 August with 4 units and full-fledged production with all 6 units from September 10, 2021.

The company has not done any adverse activities to affect the share price. After the commercial generation of electricity from September 10, 2021, the company started to generate income. However, the fluctuation of share prices has more to do with the market and share transactions. At a time when the share market is virtually collapsing, Company’s share is performing well with Rs. 535 on the day of closing of the third quarter.

With the fourth quarter financial disclosure a month away, the current share value will likely be increased because the income of the fourth quarter will be better than the earlier one given the flow of water in the river and the generation of electricity.

As the company has also been working to tighten internal expenditure aiming to reduce unnecessary spending, it will give more benefits to the public shareholders in the coming days. “The management is seriously working on how to provide more benefits to the public shareholders,” said Bigyan Shrestha, CEO of UTKHPL.

As the project started commercial production from all units on September 10, the revenue generated by the project has shown that it will be expected to generate around Rs.9 billion annually from this year.

The current share price of the UTKHPL indicates that there is growing confidence in the public regarding the future of the project. People are expecting more dividends in the process.

A Game Changer

After the completion of Upper Tamakosi, Nepal’s status in producing electricity has changed. With a surplus of energy at hand, Nepal’s policymakers have started to talk about replacing the LPG gas with electric cooking, electric vehicles and finally export of electricity.

Although the project has been delayed for a few years, it started generating and supplying electricity to the country when a major global energy crisis hit the world skyrocketing the prices of Petroleum Products including LPG.

With these, the project has not only saved over 9 billion annually importing electricity from foreign countries but also opened a way to offer benefits to shareholders and confidence among Nepali technicians.

Faced a series of unavoidable natural crises, great earthquakes, coronavirus and other obstructions in supply, 456 MW Upper Tamakoshi Hydroelectric Project, Nepal’s largest hydropower project, has started the generation of electricity and revenue turning Nepal into a self-reliant electricity generation.

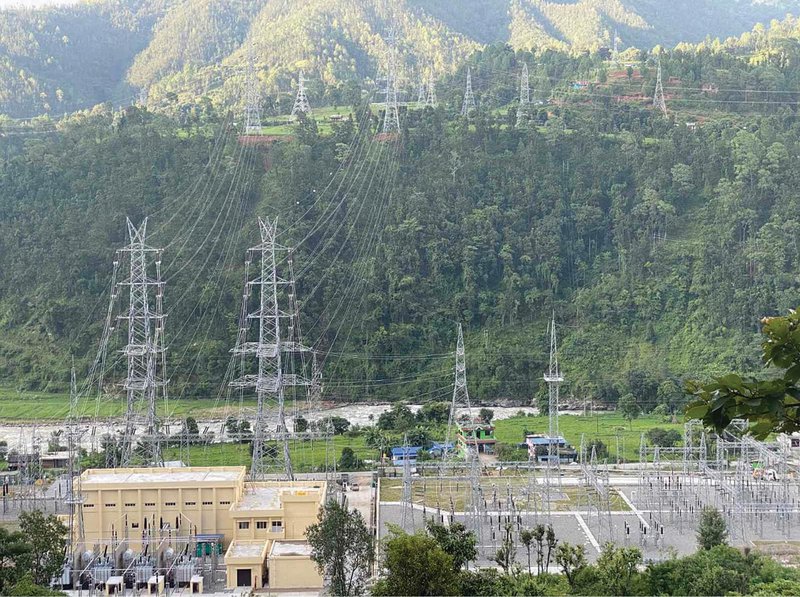

Khimti Substation

Involved in the project from inception in different positions along with first CEO Dr. Mrigendra Bahadur Shrestha, who had completed all the preliminary works to commence constructions, Chief Executive Officer of UTKHPL Bigyan Shrestha, who has led the competent team of NEA to complete the mammoth project, is now working to optimize the benefit to public shareholders and keep their faith on the project.

From the construction of roads and conducting a detailed survey of the site and preparing tenders, the first project manager Mr. Shrestha had done everything to materialize the project.

“We are now working on how to provide more benefits from the project to beneficiaries including the public shareholders,” said Shrestha. “We have completed the mammoth task of completing the project. We have also considered now starting another project like this.”

As the private sector cannot invest in projects like semi-reservoir or reservoir projects like Upper Tamakosi, the government of Nepal needs to take initiative to construct this kind of project, said Shrestha who spent a long time with the project.

“My sincere thanks go to all helping hands to serve consecutive 33+ years in Nepal Electricity Authority with the accomplishment of 456 MW Upper Tamakoshi Hydroelectric Project in this tenure,” said CEO Shrestha.

Electricity Self Reliant

After the completion of the project, the country is now self-reliant on electricity. Although there are 108 private hydropower projects that have been supplying 815MW of electricity to the national grid, no project is matching to the capacity of Upper Tamakosi in generation and price per unit.

With its daily peaking reservoir, UTKHPL can generate energy at a full capacity of 456 MW at peak time even during the dry season when the electricity production from the run of the river projects declined drastically.

The plant, the largest hydroelectric project in the country, is located in a remote region of the upper Himalayas on the Tamakoshi River, about 6 km from the border with China’s Tibet.

With a natural head of 822 m and six underground units, it produces up to 2,281 GWh of electricity annually. This renewable energy will improve living conditions and promote economic development in the country.

The major components of this project are the intake, a 22-m-high concrete dam, and twin desanding basins, a 7.86-km-long headrace tunnel, a 360-m-high surge shaft, and a 495-m-long penstock pipe, an underground powerhouse with six Pelton turbines, a 2.9-km-long tailrace tunnel, and a 47-km-long 220-kV transmission line to New-Khimti substation.

CEO Shrestha with the colleagues who worked during the construction period

All six turbines and generators have been in full operation since September 2021. During the rainy season, the total electricity generation of Nepal will exceed what the population and the economy are consuming. The country can benefit in several ways from the surplus of electricity: Electricity costs will decrease, there are plans to supply consumers in need with electricity free of charge, and Nepal could export electricity.

Clean Energy

Hydroelectric energy is one of the sustainable renewable energies with low-carbon emissions. The use of hydropower as the main source of energy for everyday activities will help to noticeably reduce fossil fuel carbon emissions in Nepal.

The Upper Tamakosi plant, however, can generate electricity at full capacity for a minimum of four hours during the dry season, according to the project. This is a historic achievement. This makes Nepal a power surplus country capable of exporting electricity.

Given its production capacity, the Upper Tamakoshi Hydroelectric Project is of high economic importance to Nepal as it has not only made Nepal an energy surplus country. But it also contributes to the national gross domestic product. Besides those imports, it also cut the import of electricity from India in the dry season-saving billions.

According to the study, the project is expected to contribute around 1 percent to the GDP and also help boost industrial production. The completion of the project has shown that Nepal can collect the fragmented capital within the country and invest in projects like Upper Tamakosi.

The completion of the project and the beginning of the generation, it has boosted the morale and confidence of the Nepalese people. The project has shown that Nepali can now develop these types of projects through their own resources and manpower.

Various reports have pointed out that Nepal has a severe infrastructure investment gap, which is slowing its economic growth. Between 2007 and 2017, the country went through a massive electricity supply shortage that caused up to 18 hours of daily load-shedding.

This load-shedding had drastic costs for Nepal's economy. According to a World Bank report, the reliable power supply would have increased the country's annual gross domestic product by almost 7 percent, and annual investment would have been 48 percent higher.

According to him, initially, the interest to be paid was estimated at Rs14 billion. “Now, the bank interest alone stands at Rs32 billion. So, the overall cost is around Rs 86 billion.” The annual interest rate has been set at 11 percent in an early loan agreement, however, it raised up to 12% for some years during construction.

On the one hand, the project is a milestone for a country like Nepal facing an infrastructure gap but it is also a reminder of how cost and time overruns impact the development aspirations

The national pride project was originally scheduled to be completed in mid-July 2016, but the 2015 earthquakes hit the project very hard. The access road leading to the project site was totally destroyed when the project had completed 79 percent of the civil works. The installation of the penstock pipes was slated for 2015. But that too saw a setback.

Substation Building

The construction work stopped for months when the hydro-mechanical contractor, Texamo Railway Engineering of India lacked the expertise to execute the difficult task of installing the penstock pipes including hydro-mechanical works.

Subsequently, the project developer, the Upper Tamakosi Hydropower Limited, appointed Andritz Hydro to fit the high-pressure steel penstock pipes when the contractor Texmaco abandoned the project.

With the average power purchase agreement (PPA) rate of Rs 4.06 per unit, it is the cheapest price of electricity for the Nepal Electricity Authority. It is beneficial for the power utility for use of peaking run-of-river (PRoR) synergy. Even after paying back the loans within a reasonable extended time, it can generate a good amount of income in the future and more power projects can be developed with it.

Challenges and Problems

At a time when the construction of the project has already been completed and the project has entered into a generation stage, the company’s target is now to minimize other expenditures and reduce interest. The cost of the project escalated due to delays in the construction period.

CEO Shrestha

Providing the good dividends to investors and ensuring the formidable income and negotiating with financial institutions for the reduction of interest rates is the target of the company,” said CEO Shrestha.

As the project has contributed immensely to the country’s overall energy scenario and economy of Nepal, once the financial institution revises the interest rates and the company manages its expenditure, it will start to give more deviant to the public shareholders.

Whatever the status of share, the Upper Tamakoshi has solidly contributed to the infrastructures development of the region. With 220 kV Transmission line, substations and roads connecting northern remote areas, Nepal’s economic activities has accelerated.

Under the infrastructures built of the project, private sectors are investing in hydropower power projects with the capacity of over 200 MW in Dolkha. From the tail race, Upper Tamakoshi V is under construction with the capacity of 100 MW.

Ray of Hope

Last year during Septemner, October and November, NEA was not in comfortable position to dispatch all available generated energy as there was not firm contract to export Surplus energy to the Indian Grid.As a result of permission to trade upto 363 MW to Indian Energy Exchange (IEX) market NEA is now in better positionto dispatch all available power including power of Upper Tamakoshi HEP.

Photos: Upper Tamakoshi

- FOREIGN EXCHANGE: Largest Deposit

- Jul 22, 2024

- IMF: Approval Of SDR

- Jul 22, 2024

- NEPAL-KOREA RELATIONS: Fifty-Years Of Warm Relations

- May 31, 2024

- NEPAL-BRITAIN: Centenary Celebration

- May 31, 2024

- POLITCS: Forming New Alliances

- May 27, 2024