With the global oil prices is nearing the $80 mark as fears of outages and a significant draw in U.S. oil, Nepalese economy has to face severe consequences in coming days.

At a time when Nepalese Rupees is plunged against lowest in the last ten years reaching Rs.110 for 1 US dollar, it will directly hit the prices of oil. Government has already raised the rate several times in the past month with Rs.110.00 (US$1) for per liter of petrol.

Nepal Students’ Union (NSU), the student wing of the main opposition, Nepali Congress (NC), already staged a demonstration to protest against the price hike in petroleum products in Kathmandu.

The agitating students demonstrated outside the government colleges demanding withdrawal of the price hike decision.

With the rise in the price, Nepal Oil Corporation continues to face the loss. It will likely to increase the price again.

According to Oil analyst by OilPrice Premium, a US based energy analyst, oil rose more than 1 percent in early trading on Friday, and is not far off of $80 per barrel. This week saw prices gain about 10 percent compared to last week after a combination of fears of Iran production outages, disruptions in Libya and a bullish stock draw in the U.S. It was only a week ago that OPEC+ promised to add 1 million barrels per day (mb/d) to the market, but it already feels like a distant memory with the oil bulls back on the march.

U.S. dials back hardline on Iran imports. Earlier this week, a State Department official laid out what sounded like a “zero tolerance” policy for nations cutting oil imports from Iran. The official said that countries need to “zero” out their imports by November, and that it would be unlikely anyone would receive a waiver. The statement led to a spike in oil prices because the market had to dramatically revise up the assumed outage from Iran. On Thursday, a State Department official appeared to soften the line. “Our focus is to work with those countries importing Iranian crude oil to get as many of them as possible down to zero by Nov. 4,” the official said Thursday. “We are prepared to work with countries that are reducing their imports on a case-by-case basis. We are serious about our efforts to pressure Iran to change its threatening behavior.” The walking back of the “zero” imports mantra suggests the U.S. fears the fallout of pushing oil prices too high.

India tells refiners to prepare for “zero” imports from Iran. India’s oil minister advised its refiners to prepare for a “drastic reduction or zero” oil imports from Iran by November, due to the threat of U.S. sanctions. India, as a close neighbor and significant purchaser of oil from Iran, appears willing to wind down oil imports from Iran even as it does not recognize the sanctions as legitimate. India’s actions are an indication that Washington could wield far-reaching influence over Iran’s oil exports, even though much of the world is not lined up with the U.S. position..”

Oil jumps on massive crude draw. The U.S. saw crude inventories plunge by 9.9 million barrels last week, another sign of a tightening oil market. Oil futures jumped more than 3 percent on the news.

- The Situation Pushes Women Journalists To Speak Louder, Experts Emphasize

- Jun 30, 2025

- SPI NEPAL: Prosperity Through Clean Energy

- Jun 30, 2025

- PM Oli Meets Spanish Prime Minister

- Jun 30, 2025

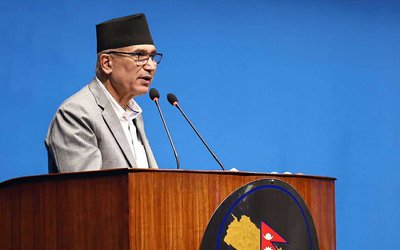

- FM Dr. Rana Said Nepal recognises constitutional guarantees to citizens' right to food

- Jun 30, 2025

- Weather Forecast: Generally Cloudy With Heavy Rainfall Is Likely In One Or Two Places Of Kathamandu, Biratnagar And Pokhara

- Jun 30, 2025