Although Nepal Rastra Bank (NRB) governor claims that the current monetary policy will support Nepal’s economic activities, it discourages the common depositors by fixing the interest rate.

As of the end of the current fiscal year, excessive money is flowing in the market because of rising capital expenditure. In the last two weeks, the government released almost Rs.60 billion as payment for development work.

With the money, the credit crunch is now somewhere solved. However, given the past experiences, it is almost certain that the credit crunch will appear within a couple of months.

At a time when the flow of remittances continues to shrink with lowering demands of Nepalese workers and Nepal’s pace of capital expenditure remains in the range of 20-25 percent, the crisis of credit crunch is looming large.

With the global trade war looming, it will have implications on the circulation of money globally. Similarly, the rise of price is also likely to affect the foreign currency reserve. Rise of price of dollar and petroleum products is likely to raise the inflation rate.

However, the monetary policy focuses more on avoiding the credit crunch and preventing the rise of interest rates.

However, the recent monetary policy recommends lower interest rates. Nepal Rastra Bank (NRB) has brought in the monetary policy for the upcoming fiscal year 2018/19 with a number of measures aimed at addressing the skyrocketing lending rates in recent months.

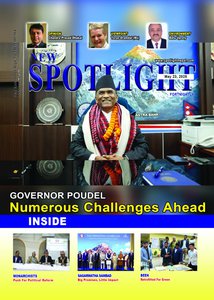

Unveiling the policy report NRB Governor Chiranjibi Nepal has reduced the average difference between the deposit rate and lending rate to 4.5 percent from 5 percent.

This measure implies that a bank would not be allowed to charge higher than 4.5 percent of their average deposit rate. As the central bank is requiring commercial banks to bring the interest spread to 4.5 percent by the end of upcoming fiscal year, the reduction in the spread will put downward pressure on runaway bank interest rates.

Along with reducing the interest spread, NRB Governor Nepal also announced that the difference between what a bank pays and charges in interest will be further cut gradually. Another way the central bank has tried to put a lid on rising lending rate is by providing banks and financial institutions (BFIs) sources of funds.

The central bank has nearly doubled the size of the refinance fund to Rs 35 billion. The increased size of the fund which was inadequate during the liquidity crunch will ensure that business firms will have financing at a concessional rate of 9 percent.

The lowering of the cash reserve ratio (CRR) and statutory liquidity ratio (SLR) for banks and financial institutions is another way that the central bank has found for putting downward pressure on the base rate of banks, which is tied to the lending rate. After five years, the central bank has lowered the CRR and SLR. CRR—the portion of the cash deposits that banks are required to park in the central bank vault—has been brought down to a flat 4 percent from 6 percent of CRR for commercial banks, 5 percent for development banks and 4 percent for finance companies.

Similarly, the SLR, the reserve requirement including both in cash and government securities, has also been lowered to 10 percent from 12 percent for commercial banks, 8 percent from 9 percent for development banks and 7 percent from 8 percent for finance companies.

“The reduction in reserve requirements for BFIs will help to free up additional cash in the banking system and ease liquidity,” said Chintamani Shiwakoti, a deputy governor of NRB. “This measure combined with other provisions like reduction in bank rate in the monetary policy will gradually correct the rising interest rates,” he added. The central bank has reduced the bank rate to 6.5 percent from 7 percent.

The central bank has also announced to provide hedging facility for the foreign currency loans that banks bring to the country to expand into productive sectors.

“The decision to reduce the spread is positive as we can now expect that it will help reduce the interest rates which have become so high that business firms were unable to afford them,” according to Shekhar Golchha, senior vice president of Federation of Nepalese Chambers of Commerce and Industry (FNCCI). “We are hopeful that this monetary policy will address the ultra-high and unpredictable interest rates regime in the country,” he added

However, for thousands of depositors, the NRB’s monetary policy is nothing more than a ritual to protect the interest of big fish. That way, as in the past two years, governor Nepal has shown his own constraints.

- MELAMCHI WATER SUPPLY: No Interruption During Monsoon

- Jun 25, 2025

- KOREAN RETURNEES: Successful Integration

- Jun 25, 2025

- UPPER TRISHULI-1: Engaging With Local

- Jun 25, 2025

- IME GROUP: Twenty Five Years Of Journey

- Jun 24, 2025

- NEPAL’S AIR POLLUTION: A Growing Health Concern

- Jun 24, 2025