Smug with the highest economic growth of 6.9 percent in 23 years, Finance Minister Krishna Bahadur Mahara presented his budget for 2017/18. Given the new local structures in place and huge budget allocation at the local level, the growth achieved this year will be difficult to sustain in the coming fiscal year.

The government has tabled a budget of Rs 1.278 trillion for the Fiscal Year 2017/18. This budget is different from the past ones as it has allocated sizable resources to the federal units for the first time. As part of the implementation of the new constitution, the central government has allotted Rs 225 billion to 744 local units and another Rs 1.02 billion for each of the seven provinces.

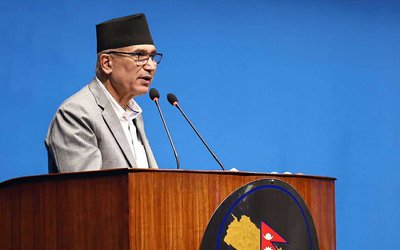

Presenting the budget in parliament, Finance Minister Krishna Bahadur Mahara said that lawmakers will no longer find the development programs of their localities in the central level budget and programs. The job of the rural municipalities, municipalities, and sub-metropolitan and metropolitan cities is to run the development program.

“The budget has been allocated based on population, development indicators and the input costs of development like price of construction materials and labor charges. As part of financial equalization, each rural municipality gets a minimum of Rs 100 million and the maximum amount is up to Rs 390 million. The range of budget allocation for municipalities and sub metropolitan cities is Rs 150 to Rs 460 million and Rs 400 to Rs 630 million,” said Finance Minister Mahara.

The local units have also received separate budget allocations as conditional grants, totaling Rs 76 billion. “The budget has empowered local units with the implementation of the constitution but the amounts allocated for the local units is not sufficient,” said former finance minister Bharat Mohan Adhikari.

The government has also decided to provide a grant to Rural Municipalities, Municipalities, and Metropolises from the Central Government. Rural Municipality would get a minimum grant of Rs 100 million to a maximum grant of Rs 390 million, Municipsality would get a minimum grant of Rs 150 million to a maximum grant of Rs 430 million. Similarly, Metropolitan cities would get a minimum grant of Rs 400 million to a maximum grant of Rs 640 million.

The government has also incorporated the provision of distributing teachers' remuneration, education materials, textbooks and scholarship amounts up to grade 10 by the local bodies.

At a time when there is no tangible source to meet the allocation, the budget is up by 36 percent compared to the revised budget of the current fiscal year. With the slowing of the remittance intake, it will affect the import of goods as well. However, the budget has targeted 26 percent revenue growth (Rs 730 billion).

The government aims to borrow Rs 145 billion from the local market but experts say this will reduce the investment the private sector relies on for growth. “The target of meeting the budget deficit will affect the economic growth target,” said Deependra Bahadur Kshetry, former governor.

Enthusiastic at the high growth rate projections of 6.94 per cent in the current fiscal year, the government has targeted at a growth rate of 7.2 percent for next year, all without tangible programs and sources.

“There will be no bouncing back. We need to maintain the current level of growth,” said Finance Minister Mahara. The present growth was projected to be the highest in 23 years on the back of improved power supplies, agricultural production and higher spending on reconstruction work after earthquakes.

Finance Minister Krishna Bahadur Mahara said the economy would grow by 6.9 percent and it will be over 7 percent next year. The forecast compares with no growth last year, following earthquakes and border blockades.

“Fewer strikes have contributed to increase industrial production and private sector investment which in turn helped achieve a higher growth rate despite the political instability,” said Deependra Bahadur Kshetry, former central bank governor. One of the major successes is that Nepal has virtually ended long power cuts of up to 20 hours through increased electricity imports from India, distribution management and theft control.”

New Budget

As the political restructuring process has begun following the first phase of elections, the budget of fiscal year 2017/18 has opened the process for economic restructuring. With no institutional backup at the local level, however, allocating the budget alone cannot be sufficient.

The question now is how the government takes steps to proper implementation of the budget and allocation of funds in new ways for a proper utilization of the funds.

According to the Ministry of Finance (MoF), the government budget was in accordance with the ceiling fixed by the National Planning Commission (NPC) as mandated by the Constitution on May 29. NPC, the apex planning body of the country, had raised the budget ceiling for fiscal 2017/18 by 10.21 per cent as compared to the current fiscal which stood at Rs 1,156.04 billion.

“The budget allocated to the local bodies is not enough. It would only cover the daily administrative cost and supportive elements of the establishment,” said former finance minister Adhikari.

As the government has spent only 22.54 per cent of the total budget of Rs 1,048.92 billion under current fiscal year (2016/2017), the fate of the new budget too does not look promising, given the past records.

“The weak performance in budget implementation is due to slow capital expenditure. If the government allocated the budget without proper administrative units and structures, the fate of the current budget will be more disastrous than the previous one,” said former finance secretary Rameshwor Khanal.

The capital expenditure of the government this year was approximately 3.8 per cent of the Gross Domestic Product (GDP) crossing the trends of last one decade. However, there is no solid basis to say that the current level of expenditure will be sustained.

As the new Constitution devolves substantial amount of power, including drafting laws, collecting certain taxes and even some judicial powers, to the local bodies, the government expects that the capital expenditure will increase.

Ambitious Budget

Out of the total budget of Rs 1, 278 billion, Rs 804 billion is recurrent expenditure, Rs 335 billion is capital expenditure and Rs 140 billion is financing provision for the coming fiscal year.

The budget has given priority to holding two phases of elections next year; expedite reconstruction projects, constitution implementation and continuation of national pride projects.

GDP growth rate would be 7.2 per cent, the highest in recent years, agriculture sector would reach 5.3 per cent, the industrial sector would grow by 11 per cent, service sector would be up by 6 per cent in the coming fiscal year. The budget also projected that the inflation rate would remain at 7 per cent in the coming fiscal year.

Without any management of alternative sources, the government has decided to add Rs 1,00,000 and provide Rs 3,00,000 to earthquake victims for the construction of a house in the quake-affected areas.

Projects for National Priority

The budget has also allotted Rs 13 billion for the completion of Pokhara and Bhairahawa regional airports and Kathmandu-Terai fast track. The government has also disbursed Rs 3 billion and 570 million for the Melamchi Drinking Water Project. The government has also vowed to upgrade the run-way of Tribhuvan International Airport.

With an aim to eradicate load shedding from the nation and plan to generate 17,000 megawatts electricity, the government has launched a program jantako Pani Janta Ko Lagani. The government has also allocated the budget of Rs. 10 billion for Budhi Gandaki Hydro Project and promised to complete Chameliya and Kulekhani III next year.

Like in the past, the government has presented a highly ambitious budget with a big target for revenue generation to meet the budget. What one can say about the budget at the moment is, it will rely more on development partners in the coming years to fulfill the expenditure than before.

Minister Mahara Presenting budget

Keshab Poudel

Poudel is the editor of New Spotlight Magazine.

- FOURTH PROFESSOR Y.N. KHANAL LECTURE: Nepal-China Relations

- Jun 23, 2025

- Colonel JP CROSS: Centenary Birthday

- Jun 23, 2025

- REEEP-GREEN: Empowering Communities with MEP

- Jun 16, 2025

- BEEN: Retrofitted For Green

- May 28, 2025

- GGGI has been promoting green growth in Nepal for a decade: Dr. Malle Fofana

- May 21, 2025