Nepal Rastra Bank (NRB) has announced a new monetary policy for fiscal year 2017/018. The new policy also raised the lending requirement for commercial banks toward productive sectors by 5 percentage points to 25 percent of their total lending.

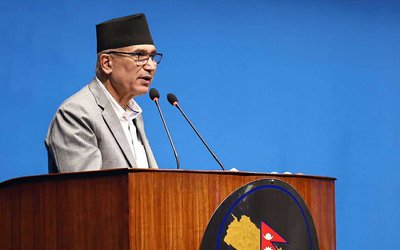

Speaking at the event, NRB governor Chiranjibi Nepal shared that monetary policy has prioritized agriculture, tourism, energy, small and cottage industries and liquidity management.

According to the policy, the central bank said that the 'A' class commercial banks must float 25 percent of their total loans to productive sectors by mid-July, 2018.

NRB said Nepal’s economic growth rate is satisfactory. “Nepal’s balance of payment is satisfactory, the financial imbalance is decreasing and there is a positive change in the economy.

The NRB said investment would be made in prioritized projects by using monetary instruments to achieve a 7.2 percent economic growth rate in the next fiscal year.

Similarly, the NRB has also allowed commercial banks a deadline of mid-October to bring their core-capital-cum-deposit (CCD) ratio requirement to the regulatory limit of 80 percent. While the NRB allowed the regulatory relief on a calculation of the CCD ratio by deducting 50 percent of productive sector loans to expire, the flexibility of the deadline to bring the CCD ratio to regulatory limit means that BFIs would not be penalized for breaching such prudential lending limit until mid-October.

However, the private sector criticized the monetary policy saying that it did not match to a national budget which aspires to achieve 7 percent growth. “This policy is incomplete and fails to address the current cash crunch and rising interest rate,” said Shekhar Golchha, first vice president of Federation of Nepalese Chamber, Commerce and Industry (FNCCI).

- MELAMCHI WATER SUPPLY: No Interruption During Monsoon

- Jun 25, 2025

- KOREAN RETURNEES: Successful Integration

- Jun 25, 2025

- UPPER TRISHULI-1: Engaging With Local

- Jun 25, 2025

- IME GROUP: Twenty Five Years Of Journey

- Jun 24, 2025

- NEPAL’S AIR POLLUTION: A Growing Health Concern

- Jun 24, 2025